Homeownership Opportunities

Habitat for Humanity Metro Maryland home purchase applications are NOW CLOSED.

Home Purchase Program:

https://habitatmm.org/home-purchase/

Join our email notification list for future announcements and upcoming opportunities:

Habitat for Humanity Metro Maryland staff will contact you regarding future homeownership opportunities as they become available.

Click here to join

Find Your Local Affiliate:

https://www.habitat.org/volunteer/near-you/find-your-local-habitat

Additional Resources:

https://habitatmm.org/how-to-apply/additional-resources.html

Habitat for Humanity Metro Maryland does not handle or review applications for RENTALS at Allium Place. If you are interested in RENTING at Allium Place, follow the link below to apply and get more information.

Click here

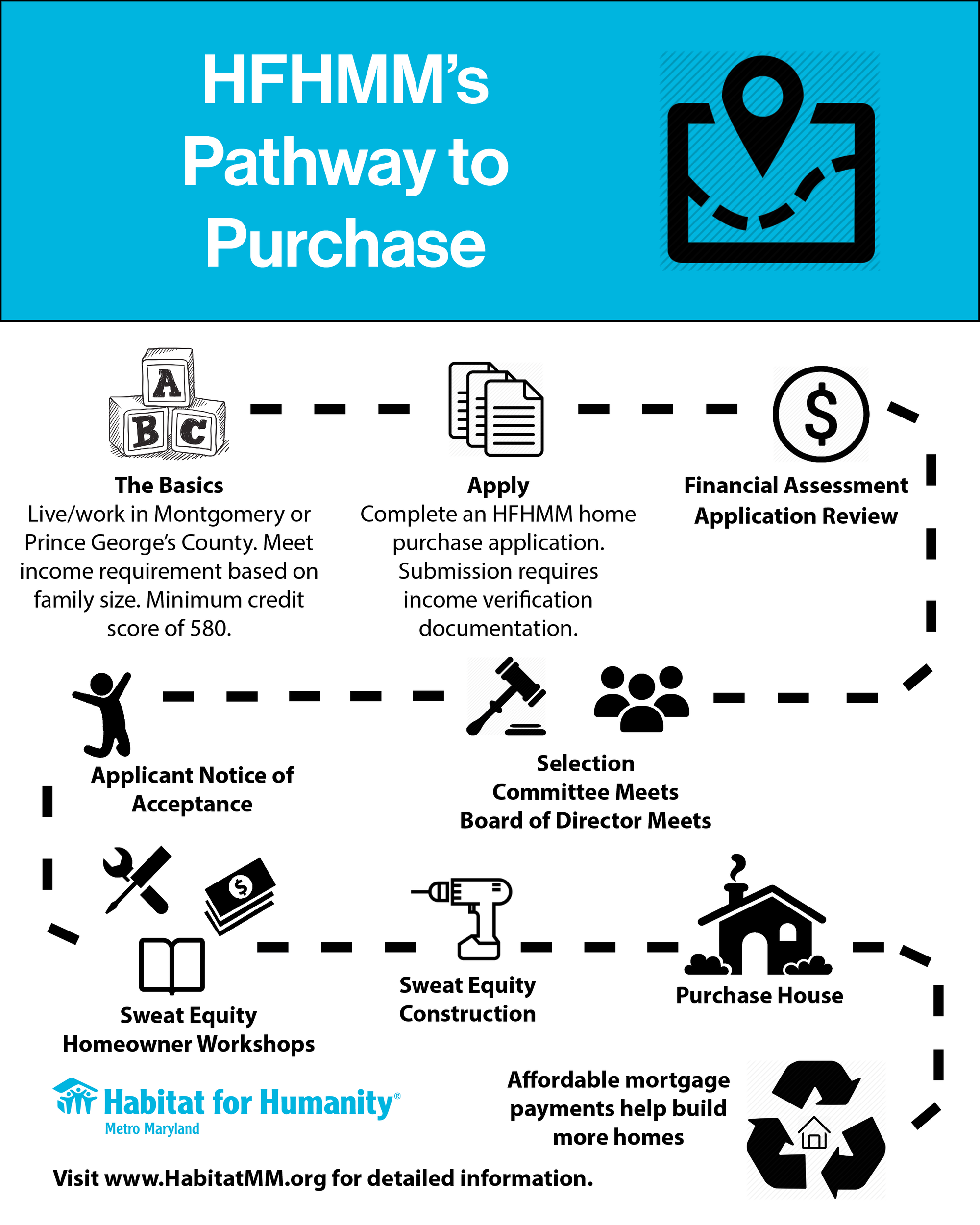

How To Apply for a Home with Habitat for Humanity Metro Maryland

Together with Habitat, through financial coaching, homebuyer training and sweat equity, your family can pursue this dream. Habitat Metro Maryland offers the opportunity for you to buy a Habitat-built home. We’ll work with you to determine what’s affordable to you and assist you in the buying process, which is outlined below.

Habitat for Humanity has also compiled a helpful list of resources for local families. Topics include employment, finances, health and safety, legal support, home maintenance, seniors and veterans, and more.

Apply Through Habitat Metro Maryland

Requirements for Homeownership

First, families will attend an orientation session and then submit an application. Selected families will be notified to proceed further. Please read through the 5 Steps to Homeownership outlined below to learn about Habitat’s application process.

Click here to join our notification list. Although we do not have any orientation sessions scheduled at this time, your contact information will be added to our email list. Habitat for Humanity Metro Maryland staff will contact you regarding future homeownership opportunities as they become available.

5 Steps to Homeownership

1. INITIAL PROGRAM REQUIREMENTS

Requirements for Homeownership:

- You must have lived or worked within Montgomery or Prince George’s County for at least one year

- You must contribute up to 500 hours of sweat equity based upon family size

- Proof of Citizenship or Permanent US Residency

- Habitat homebuyers must have an annual household income between 30% to 60%, and in some cases up to 80% of the AMI (Area Median Income) as determined by HUD.

2. HABITAT HOMEOWNERSHIP ORIENTATION– Please check back for future orientation dates and times

3. APPLICATION PROCESS

Submit an application to the Habitat Metro Maryland homeownership program. Completed applications should include the following documentation:

- All sections of the application form filled in – no blank spaces

- Proof of Income (paystubs, taxi manifests, etc.): self-employed individuals including contractors, Uber/Lyft/Taxi drivers, etc. will be required to submit financial statements and or detailed daily manifest

- Bank statements

- W-2 forms most recent 2 years

- Income tax returns (State and Federal) all pages most recent 2 years

- Photo ID

- Credit Report Fee (the fee is based upon the number of applicants: $40 for one applicant OR $80 for two or more applicants)

- Minimum Credit Score of 580 or better

Applications should be submitted via US mail. Once your application is received, Habitat staff will assess your income and credit eligibility.

4. APPLICATION REVIEW

- The home visit has three goals:

- To determine housing need

- To discuss the mortgage and loan packages as well as home specifications

- To answer questions

5. NOTIFICATION OF SELECTION AND DECISION

Inevitably, there will be more qualified homebuyers than homes available so not all qualified families will be able to purchase. Please do not let a denial from HFHMM end your search to purchase a simple, decent, affordable home in Montgomery or Prince George’s County, Maryland.

For more details about our Home Purchase program click here.

Local Resources

Housing Opportunities Commission of Montgomery County

https://www.hocmc.org/rental-programs/housing-path.html [hocmc.org]

Housing Initiatives Partnerships

https://hiphomes.org/housing-development/single-family-homes/

[hiphomes.org]

City of Gaithersburg Homebuyer Assistance Loan Program (GHALP)

https://www.gaithersburgmd.gov/services/housing-services/homebuyer-assistance-loan-program [gaithersburgmd.gov]

State of Maryland Mortgage Program – Department of Housing and Community Development

https://mmp.maryland.gov/Pages/Programs.aspx [mmp.maryland.gov]

Equal Housing Statement

Habitat for Humanity Metro Maryland is pledged to the letter and spirit of U.S. policy for the achievement of equal housing opportunity throughout the nation. We encourage and support an affirmative advertising and marketing program in which there are no barriers to obtaining housing because of race, sex, marital status, physical or mental disability, color, religion, national origin, ancestry, presence of children, source of income, sexual orientation, gender identity, age and family responsibilities.